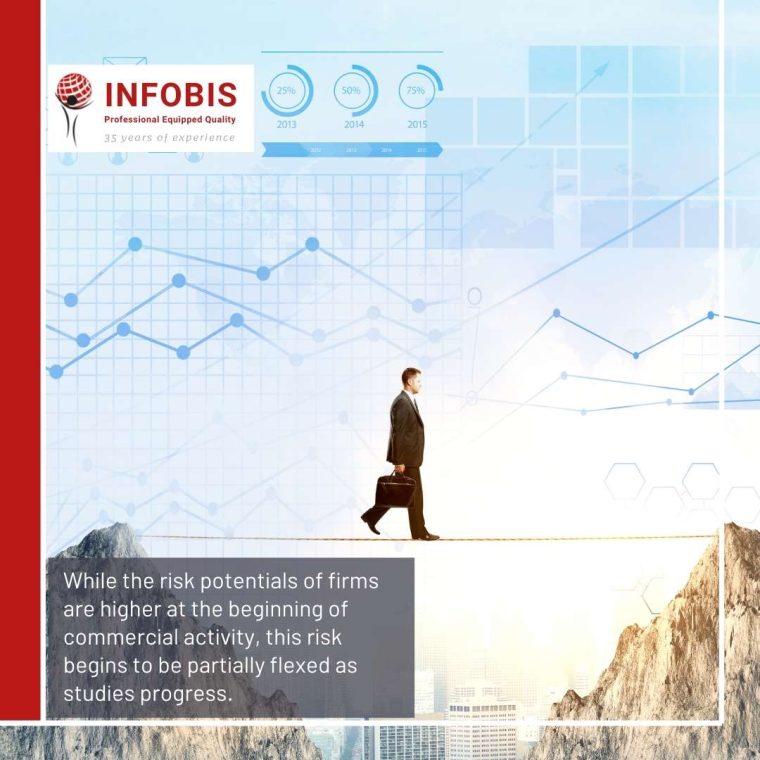

As trade becomes multidimensional, payment processes for companies working in B2B are credited with mutual agreements. While the risk potentials of firms are higher at the beginning of commercial activity, this risk begins to be partially flexed as studies progress. The payment term and credit limit of the billed amount are increased simultaneously with the financial potential of the customers. In companies that work with more than one supplier or customer, risk analysis is usually measured by the fact that payments are made just in time. Infobis provides credit risk reports periodically or continuously for businesses that are aware of the fact that credit risks cannot be measured only by timely payments. In this way, it contributes to preventing financial crises that are likely to occur. . For more information, you can contact us now. 📞 +90 (212) 356 1220

Professional Equipped Quality

#creditrisk #creditriskmanagement #creditriskanalytics #financialrisk #financialriskmanagement #consultancy #financialrisk #analysis #capital #europecreditteam #europefinancialcrisis #b2b #businesstobusiness #domesticcommercialreports #business #data #quality #internationalvommercialreports #dealershipcommercialreports